MUTUAL FUND

A mutual fund is a type of financial tool which is made up of a pool of money collected from many investors and further this amount is invested in different investment tools like stock, bond, market instruments, gold etf, and many others

One can start with a small amount (RS 500 per month)

Types of Mutual Fund

It basically invest in equity (stock) .It is basically for those investors who are looking for long term investment prospective.

Large Cap :Refer top 100 companies in terms of market capitalization

Mid Cap:From 101 to 250 companies in terms of market capitalization

Small Cap:From 251 onwards companies in terms of market capitalization

Multicap:It’s a combination of Large cap ,Mid cap & Small cap with a minimum investment in equity is 65% of total asset

ELSS Fund:Equity Linked Saving Scheme. It helps to take tax benefit under {sec 80 C} It has a statutory lock in period of 3 yrs. The income tax offers deduction in tax under provision of Income tax Act 1961

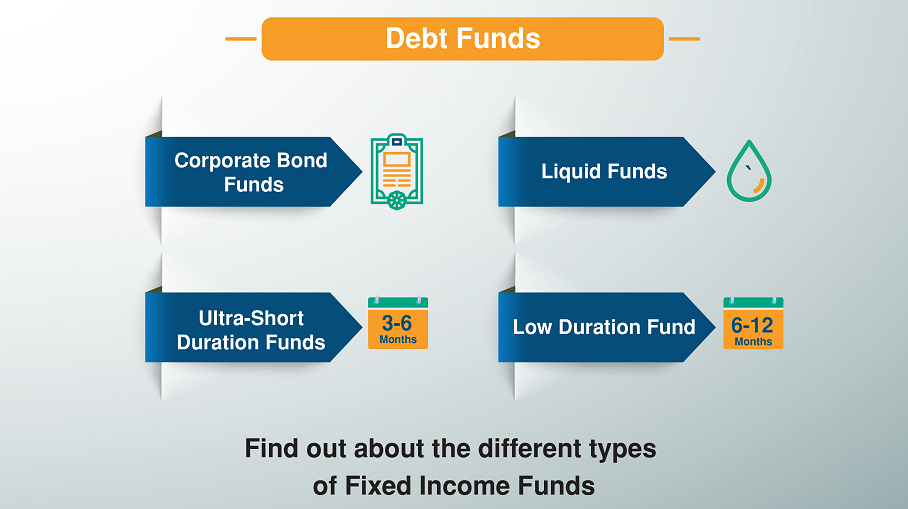

2} Debt Fund

It basically invests in securities like bonds, debentures, government securities and money market instruments.

As it is less risky as compare to equity funds and also less volatile comparative to equity funds.

Types of Debt funds

- Overnight Fund

- Liquid Fund

- Low Duration Fund

- Short Duration Fund

- Ultra-Short Duration Fund

- Credit risk Fund

- Corporate Bond Fund

- Dynamic Bond Fund

- Gilt Fund

3}Balance Fund

This type of fund invests around 60% in Equity & 40% in Debt instruments.

4}Hybrid funds

This type if fund invest in combination of stocks and bonds

Asset allocation fund

Balanced Advantage Fund

Aggressive Hybrid Fund

Conservative Hybrid Fund

INVEST THROUGH LUMP SUM OF SIP

One can start investing in mutual funds in either way either through SIP OR LUMPSUM

One can start sip by just RS100 per month in few schemes only

One can start with a onetime investment by Min Rs 5000 and Rs 1000 in few schemes

Benefits from investing in Mutual Funds

- Liquidity

- Diversification

- Tax benefit

- Affordability

- Can start with a very small amount

ELSS{EQUITY LINKED SAVING SCHEME}

The income Tax Act 1961, under Sec 80C one is allow to invest upto INR 1.5 LACS and can claim it as a deduction under his taxable income

One can save upto Rs 46800 in taxes by investing in ELSS Scheme

There is locking of 3 yrs in ELSS Scheme

This in one option as there are lots of options available to save tax under Sec 80c

Mutual Fund investments are subject to market risks, read all scheme related documents carefully before investing.