Nippon India Multi Asset Fund

(An open ended scheme investing in Equity, Debt and Exchange Traded Commodity Derivatives and Gold ETF)

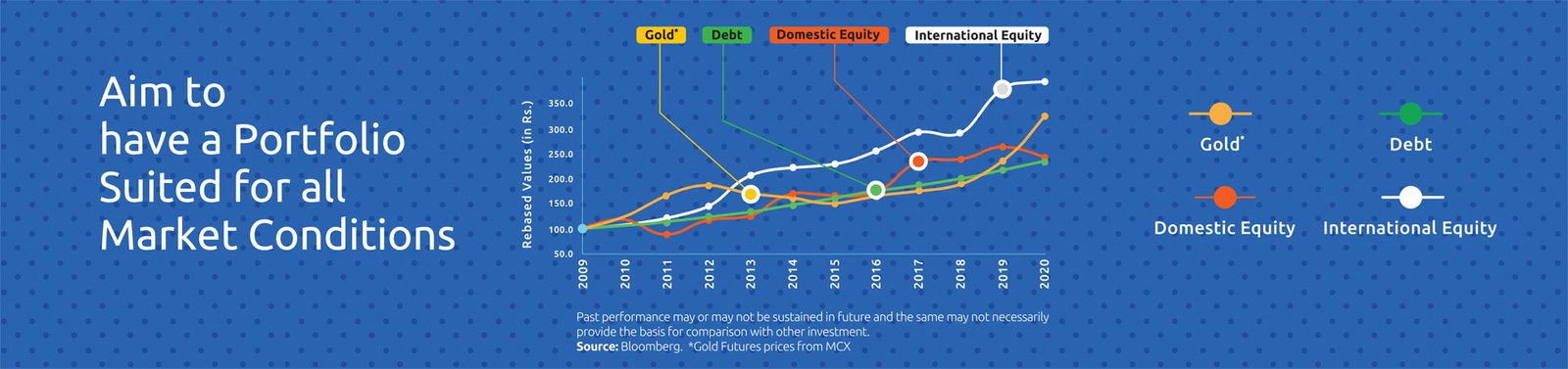

A Multi Asset Fund which invests in a combination of Equity, Debt, International Equity and Gold ETF/ Exchange Traded Commodity Derivatives (ETCD) and other ETCDs as permitted by SEBI from time to time. These asset classes are weakly/ negatively co-related and tend to perform at different periods of time. Aim to benefit from portfolio diversification.

The scheme will invest in Gold ETF/ETCD/Sovereign Gold Bonds. Investors are requested to note that investment into physical Gold is neither envisaged nor is part of the core investment strategy in the schemeNFO Open Date: 7 Aug, 2020 | NFO Close Date: 21 Aug, 2020Enter Your PANInvest Now

Product NoteScheme Information DocumentsKIM cum application formhttps://www.youtube.com/embed/MrfA-RfOQPM

Why Multi Asset Fund

- #According to various studies, more than 90% of the portfolio returns are based on asset allocation decisions.

- This happens because Asset classes follow different performance cycles. In other words, they have low / negative correlation with each other

- It is difficult to predict which asset class will outperform at a given point in time

- It is therefore best to have a fixed asset allocation within your portfolio at all points in time

- This helps in portfolio diversification, relative reduction of overall risks and could lead to optimisation of returns.

- But it is important that the fund you select invests across asset classes in a defined manner

Source:#Does Asset Allocation Policy Explain 40%, 90% or 100% of Performance?

Why Nippon India Multi Asset Fund

- Nippon India Multi Asset Fund is a true-label fund, investing across various asset class in a definite manner.

- Probable Allocation amongst different asset classes

- Domestic Equity (50%):

Within Domestic Equity, the fund would invest 50-70% into large caps, the rest would pre-dominantly be in mid-caps - International Equity (20%):

International equity would be across geographies based on prevailing view/tactical opportunity. Overseas equity could act as an effective diversification tool as well as benefit from any currency depreciation. - Commodities (15%):

The fund will have the flexibility to invest in various commodities* to provide diversification within commodities as well. Investment will predominantly be into Gold ETFs/ETCD. Gold^ will be the key diversifier given the low co-relation to Equity & Debt. - Fixed Income (15%):

Fixed Income allocation will be predominantly in good credit quality assets. 85% of securities will be AAA followed by AA+ and AA

- Domestic Equity (50%):

Note: The above exposure is subject to change within the limits of SID depending on fund managers views and the market conditions.

Model Portfolio vs individual Asset Classes – 3 year rolling returns

- A Model portfolio based on the above asset allocation, over the last 10 years gave us these results:

The Model Portfolio has generated a 3 year average rolling return of 12%, similar to equity but with a much lower risk profile – standard deviation almost half as much as that of equity, 90% of the times 8% plus returns and 79% of the times 10% plus returns, in the last 10 years. Essentially the model portfolio generated Equity like returns with much lower risks.

Note: The above exposure is subject to change within the limits of SID depending on fund managers views and the market conditions.

| 3-yr Rolling Returns for last 10 yrs (August 2010 – July 2020) | |||||

| Portfolio | Gold^ | Debt | Domestic Equity | Overseas Equity | |

|---|---|---|---|---|---|

| Average | 12.0% | 4.4% | 8.5% | 12.0% | 14.8% |

| Minimum | -1.8% | -8.3% | 6.9% | -6.4% | 2.4% |

| Maximum | 19.5% | 22.0% | 10.2% | 24.7% | 29.4% |

| Standard Deviation | 3.4% | 6.6% | 0.8% | 5.6% | 5.9% |

| Negative Instances (%) | 0.2% | 27.3% | 0.0% | 3.8% | 0.0% |

| Above 8% | 90% | 25% | 65% | 83% | 92% |

| Above 10% | 79% | 21% | 1% | 72% | 76% |

| Above 12% | 49% | 16% | 0% | 52% | 60% |

Note: 1) Model Portfolio comprises of weighted allocation to S&P BSE 100 TRI (25%), S&P BSE Mid Cap TRI (25%), MSCI World Net Return Index (in INR terms) (20%), Gold Futures prices from MCX (10%), Crude Oil prices (in INR terms) (5%) and CRISIL Short Term Bond Fund Index (15%); 2) For Equity, S&P BSE 100 TRI returns are considered; For International Equity, MSCI World Net Return Index returns (in INR terms) are considered; For Debt, CRISIL Short Term Bond Fund Index returns are considered; 3) Returns & Standard Deviation are calculated based on 3-year rolling returns rolled on a daily basis for the period between August 2010 to July 2020. Total No. of Instances: 1652

^The scheme will invest in Gold ETF/ETCD/Sovereign Gold Bonds. Investors are requested to note that investment into physical Gold is neither envisaged nor is part of the core investment strategy in the scheme.

Disclaimer: Model Portfolio is for illustrative purpose only just to explain the concept of asset allocation and should not be construed as an investment advice or direct or indirect solicitation for the scheme or the performance.

Source: Bloomberg, MFI Explorer.

*Includes Gold ETF and Exchange Traded Commodity Derivatives (ETCDs) where participation will be limited to derivatives contracts in Metals, Energy and Indices as permitted by SEBI from time to time.

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment.

This product is suitable for investors who are seeking*

- Long term capital growth

- Investment in equity and equity related securities, debt & money market instruments and Exchange Traded Commodity Derivatives and Gold ETF

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them

Investors understand that their principal will be at Moderately High risk

Disclaimer: The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers Certain factual and statistical information (historical as well as projected) pertaining to Industry and markets have been obtained from independent third party sources, which are deemed to be reliable. It may be noted that since Nippon Life India Asset Management Limited (NAM India) (formerly known as Reliance Nippon Life Asset Management Limited) has not independently verified the accuracy or authenticity of such information or data, or for that matter the reasonableness of the assumptions upon which such data and information has been processed or arrived at NAM India does not in any manner assures the accuracy or authenticity of such data and information. Some of the statements assertions contained in these materials may reflect NAM India’s views or opinions, which in turn may have been formed on the basis of such data or information

Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision. None of the Sponsors, the Investment Manager, the Trustee, their respective directors, employees, affiliates or representatives shall be liable in any way for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including on account of lost profits arising from the information contained in this material.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.